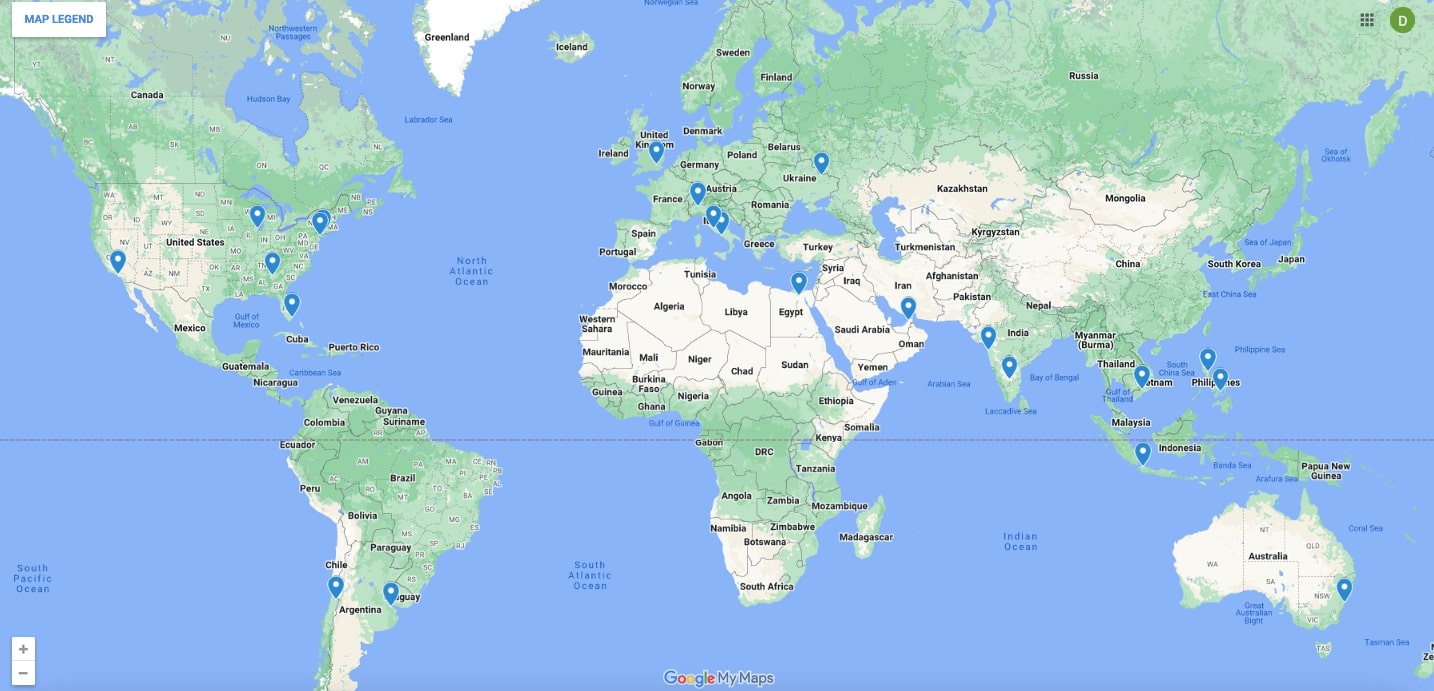

The Italian Foreign Ministry has launched a new portal for booking consular services appointments at its consultates around the world. Appointments are open to both expatriate Italians seeking citizen services and prospective immigrants applying for Italian residency, citizenship and other services. Called Prenota Online, it is being rolled out worldwide this year. Click here to find your local Prenota site.

Davies & Associates is a one-stop shop for all Italian immigration services. We provide legal assistance with Italian residency, citizenship, tax, property, student visas. We also offer Italian-language support for Italians seeking to move from Italy to the United States. Our Italian presence in the United States is led by Matteo Tisato in Miami. The South of Florida is home to one of the largest Italian expatriate communities in the United States. Matteo is also the key point of contact for our US and global clients seeking Italian immigration and business services. Matteo works closely with our teams located in Florence, Rome and Milan.

Visit D&A Italy Practice Homepage

Cambia il servizio di prenotazione dei consolati Italiani all’estero. Sia che tu sia un cittadino italiano residente all’estero o un cittadino americano che intende fare richiesta per un visto italiano, da oggi potrai utilizzare un nuovo servizio di prenotazione “Prenot@Mi”, il quale sostituisce il servizio precedente aggiungendo funzionalità innovative e semplificate.

Il nostro studio da anni fornisce assistenza legale in materia di immigrazione, assistendo una vasta clientela in materia di residenza, cittadinanza, tassazione, compravendite immobiliari, visti. Offriamo anche supporto in lingua italiana per gli italiani che cercano di trasferirsi negli Stati Uniti. La nostra presenza italiana negli Stati Uniti è guidata da Matteo Tisato, il quale gestisce il nostro ufficio di Miami, in quanto la Florida ospita una tra le più importanti comunità di espatriati italiani nel continente americano. Matteo è inoltre il punto di riferimento per tutti nostri clienti statunitensi e globali che cercano servizi di immigrazione e affari in Italia. Matteo lavora quotidianamente a stretto contatto con i nostri teams situati a Firenze, Roma e Milano.

Italian Residency

The most popular Italian visa category for our firm is the Elective Residency Visa. To apply you need to be able to prove you have at least €32,000/year in funds earned outside of Italy and a place to stay. An alternative pathway to residency is through investment – the Italian government slashed the prices of its Investor Visa last year and now options start from $250,000. A new tax system designed to attract High Net Worth Individuals and retirees as well as self-employed workers was introduced three years ago.

Italian Citizenship

After ten years’ residency a person can apply for Italian citizenship (2 years for EU citizens and a less clear picture for British post-Brexit). An alternative path to Italian citizenship is through lineage. If you are able to prove you have an Italian ancestor you may be eligible for citizenship. This option is especially popular in Latin America – Brazil, Argentina, Venezuela – because of considerable Italian migrant exodus in the early twentieth century.

Other Services

Italy can be quite bureaucratic at times and Davies & Associates network across Italy can help with relocation including explaining all the necessary steps on arrival, and help with finding and signing on a rental or purchased property.

Services for Italians

D&A has helped many Italians move to the United States. The most popular visa is the E-2 Treaty Investor Visa, which allows the holder to move their families to the US to invest in and run a business. Spouses are eligible for work authorization. The visa is renewable indefinitely, so long as the underlying business remains in operation.

Alternative visas are the L-1 Visa for the transfer of a manager or specialized knowledge employee from the Italian office of your firm to the US office (if you do not yet have an office you can create one and apply for the L-1 Visa). The EB-5 Investor Visa requires a $900,000 investment for US permanent residency – it is only used by a small number of Italians each year.

Whether you are looking to move to Italy or you are an Italian living overseas, Prenota will be your online booking system for all future consular appointments. For any questions about Prenota, Italian immigration, or Italian emigration, contact Matteo Tisato for a free consultation.

I nostri servizi per la clientela Italiana

Davies & Associates assiste centinaia di Italiani nel trasferirsi negli Stati Uniti. Nella maggioranza dei casi, la nostra clientela Italiana decide di richiedere il Visto E2, il quale consente all’investitore e alla propria famiglia di trasferirsi in America a seguito di un investimento sostanziale. Questo visto è sempre rinnovabile, a condizione che il business sia operativo.

In alternativa, una soluzione può essere data dal Visto L-1, che si rivolge a Manager d’azienda o lavoratori specializzati che necessitano di lavorare in una succursale americana. Una parte minoritaria decide invece di richiedere direttamente la Green Card grazie ad investimenti di almeno 900,000 dollari.

This article is published for clients, friends and other interested visitors for information purposes only. The contents of the article do not constitute legal advice and do not necessarily reflect the opinions of Davies & Associates or any of its attorneys, staff or clients. External links are not an endorsement of the content.